WNY Manufacturing By the Numbers

By Ben Rand

The latest economic figures are in and, surprise, manufacturing is alive and well and even growing in Buffalo/Niagara.

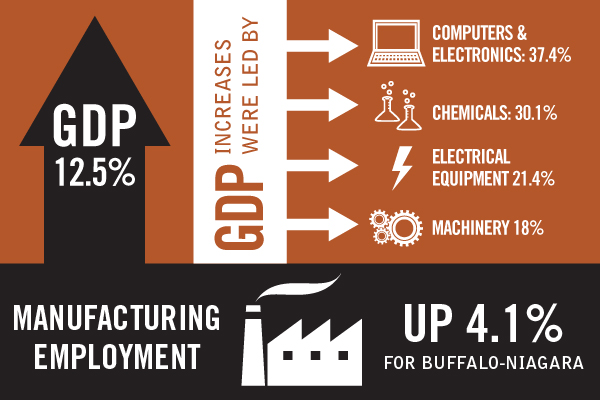

Manufacturing gross domestic product, or GDP—the total value of all goods produced—increased 12.5% year-over-year from 2010 to 2011, and increased 7.4% from 2005 to 2011, based on the latest data available from the U.S. Bureau of Economic Analysis for the Buffalo/Niagara Metropolitan Area.

These manufacturing GDP increases were led by computers and electronics +37.4%; chemicals +30.1%; electrical equipment +21.4%; and machinery +18.0%, according to the latest data available by industry from 2005 to 2010. The largest declines over that same period were in primary metals -52.4%; printing -24.6%; wood products -19.1%; and fabricated metal -17.1%.

Manufacturing employment was also up from 2010-2011, according to figures from the New York State Department of Labor. From January 2010 to December 2011, manufacturing employment was up 4.1% for Buffalo-Niagara, compared to a 3.6% increase in all non-farm employment over the same period. That equates to 51,300 manufacturing jobs as of December 2011. Since then, the numbers have slipped to 50,600, as of May 2013.

How could manufacturing GDP go up 12.5% when employment only increased 4.1% over the same period?

Productivity is up. As companies automate and/or improve their manufacturing processes, they make more product with less labor per unit. That scenario typically results in higher profits. So we have a very positive situation where output is growing, employment is growing (albeit at a lower rate) and profitability is presumably growing resulting in healthier companies and a stronger manufacturing sector.

How does that jibe with plant closings over the last three years in Buffalo, Dunkirk, Jamestown, Medina, Olean and Silver Creek?

In each of these cases, with the exception of Crawford Furniture, parent companies headquartered outside of WNY decided to consolidate manufacturing plants, taking the manufacturing previously done in WNY facilities and moving it to plants outside the area. Such moves are typically a boon for the surviving plant, which increases its production volume and often needs to add jobs and capital investment to accommodate the additional work.

This scenario illustrates that productivity and profitability are relative. Even strong plants are susceptible to this kind of consolidation if their sister plants are stronger and/or if business conditions (taxes, regulations, etc.) are more favorable in another state, another country or another continent.

The moral of this story is: No matter how productive and profitable your manufacturing plant is, you need to work continually to make it more so, to improve.